In the dynamic landscape of commerce, profit stands as the ultimate measure of a business's health and potential. Understanding profit as a multi-layered system allows entrepreneurs to see beyond simple numbers, uncovering the intricate web of factors that drive success or lead to failure.

This article delves into the anatomy of profit, breaking it down into its core components to provide a practical guide for building and sustaining a profitable enterprise. By exploring revenue drivers, cost controls, and operational efficiencies, you can gain insights that translate into actionable strategies.

From the basic formula of revenue minus expenses to the nuanced layers that influence outcomes, mastering profit is key to long-term viability. Gross profit to net margins reveal the story behind the numbers, guiding decisions that impact every aspect of your business.

Profit begins with clear definitions, as different types highlight various aspects of financial performance. Gross profit, operating profit, and net profit each serve distinct purposes in evaluating business health.

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue. It measures the efficiency of production or service delivery, indicating how well a business manages its direct costs.

Operating profit takes into account operating expenses such as marketing, administration, and research and development. This layer reflects the core profitability of business operations, excluding non-operating items.

Net profit is the final figure after all expenses, including taxes and interest, are deducted. It represents the actual income available to owners or for reinvestment, and it's crucial for assessing overall success.

To illustrate, here are the key profit types with their formulas:

Understanding these types helps in pinpointing areas for improvement, whether it's reducing COGS or optimizing operating costs.

The income statement is a financial roadmap that outlines how profit is generated. It starts with revenue streams, which can include sales, royalties, or other income sources.

Revenue serves as the foundation, and diversifying it can enhance stability. For instance, non-core activities contribute to 30% of revenue for S&P 500 companies, showcasing the importance of multiple income sources.

Cost of goods sold (COGS) represents direct expenses tied to production. In retail, COGS often accounts for 60-70% of revenue, highlighting the need for efficient supply chain management.

Gross profit emerges after subtracting COGS, and it's a critical indicator of product or service profitability. Revenue streams minus direct costs set the stage for further financial analysis.

Operating expenses encompass sales, marketing, administration, and more. These are the ongoing costs of running a business, and controlling them is essential for maintaining healthy margins.

Operating profit is what remains after operating expenses, providing insight into operational efficiency. It excludes items like interest and taxes, focusing purely on business activities.

Non-operating income and expenses, such as interest or one-time gains, are factored in next. For large firms, interest expenses can be substantial, with Fortune 500 companies facing $230 billion in 2023.

Taxes are the final deduction, with effective rates around 18-22% for corporations. Net profit is the bottom line, reflecting the true earnings after all obligations.

Monitoring margins—gross, operating, and net as percentages of revenue—is key to optimization. For example, a low net margin might signal the need to cut non-essential costs or increase prices.

Here are the key components of an income statement for clarity:

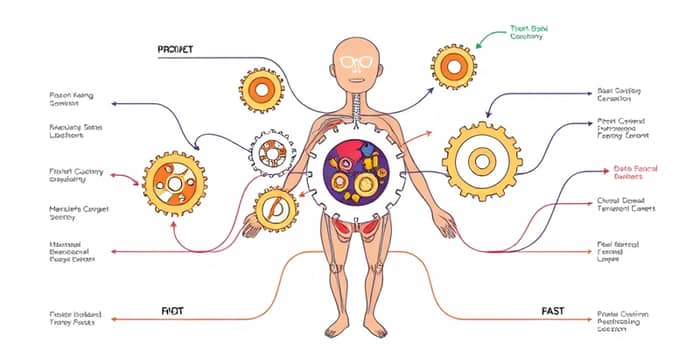

Beyond the income statement, profit can be viewed through seven interconnected layers that influence overall success. This framework, derived from business analysis, addresses everything from customer acquisition to final margins.

Each layer builds upon the previous one, creating a cascade effect where improvements in one area boost profitability across the board. The seven layers of business profit offer a holistic approach to growth and efficiency.

Here is a detailed table outlining each layer, its description, and optimization insights:

This layered approach emphasizes that profit is not a single entity but a result of multiple factors working in tandem. By addressing each layer, businesses can create a robust system that withstands market fluctuations.

Achieving sustained profit requires more than just financial management; it involves strategic elements that drive growth and resilience. Key factors include product-market fit, unit economics, leadership, and technological adoption.

Product-market fit is critical, as 42% of business failures are due to no market need. Validating customer demands before scaling can prevent costly mistakes and ensure relevance.

Unit economics refers to the profitability per customer or transaction. Positive unit economics means that each sale contributes to overall profit, providing a foundation for scalable growth.

Leadership and team dynamics play a significant role. Experienced founders have a 30% success chance, and factors like self-discipline and communication are vital for navigating challenges.

Processes such as KPIs and cash flow management are essential. With 60% of small businesses facing annual cash flow issues, implementing robust systems can mitigate risks.

Technological and digital transformation is increasingly important. 78% of global companies use AI for workflows, and investments are projected to reach $8.5 trillion by 2025, driving efficiency and innovation.

Here are some actionable drivers to focus on:

Product-market fit and unit economics are foundational, while leadership and team communication sustain momentum. Embracing digital transformation and AI adoption can provide competitive advantages in today's fast-paced environment.

Understanding the pitfalls that lead to business failure is crucial for mitigation. Statistics show that 20% of new businesses fail within two years, and 65% within ten years, often due to preventable issues.

Cash flow problems are a major culprit, accounting for 82% of small business failures. Proper management, including forecasting and reserve funds, can address this common challenge.

Lack of market need is another significant factor, with 42% of failures attributed to it. This underscores the importance of thorough market validation before launch.

Poor execution and teamwork contribute to 23% of failures, highlighting the need for skilled personnel and effective collaboration. Industries vary in resilience; for example, tech has a 63% failure rate but also produces high-growth unicorns.

To combat these risks, consider the following strategies:

Cash flow management strategies are vital, and industry-specific survival rates offer valuable insights. By learning from common failures, businesses can proactively shield themselves from similar fates.

Building a profitable business is an ongoing journey that requires attention to detail and adaptability. The anatomy of profit teaches us that success stems from interconnected elements, each reinforcing the others.

First, focus on the basics: ensure revenue exceeds expenses, and monitor all profit types. Gross profit indicates production efficiency, while net profit reflects overall health.

Second, embrace the seven-layer framework to optimize every stage of the customer journey. From attracting traffic to maximizing margins, each layer offers levers for improvement.

Third, prioritize drivers like product-market fit and unit economics. These foundational aspects determine whether a business can scale profitably or not.

Fourth, mitigate risks by addressing cash flow and market validation. Use data-driven insights, such as the high failure rates in certain industries, to inform decisions.

Finally, leverage technology and innovation. With 87% of executives viewing innovation as essential, staying ahead of trends can secure long-term viability.

To summarize, here are essential metrics and practices to adopt:

Key performance indicators for optimization should guide daily operations, while interconnected profit layers boost revenue when managed cohesively. By applying these lessons, you can deconstruct and reconstruct profit for enduring success.

References