In an ever-changing financial landscape, the quest for wealth can feel overwhelming. But true financial security isn't about chasing fleeting trends; it's about building something enduring.

A portfolio you can truly trust is the cornerstone of lasting prosperity. This trust stems from resilience, the ability to weather storms and grow steadily over time.

By focusing on strategic diversification and long-term planning, you can create an investment foundation that supports your dreams. Every investor's journey is unique, yet the principles of reliability remain constant.

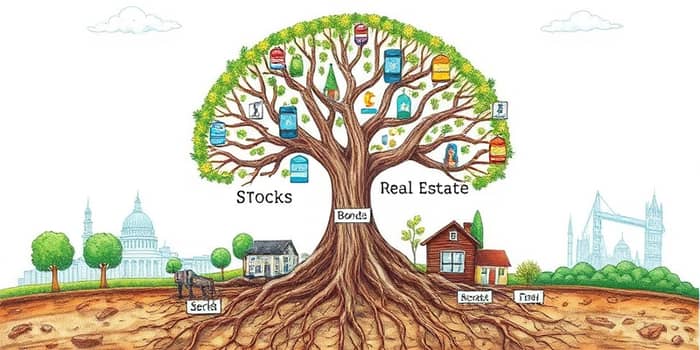

The Unshakeable Power of Diversification

Diversification is more than a buzzword; it's a proven method to minimize risk and enhance stability. By spreading your investments across various assets, you avoid putting all your eggs in one basket.

Historical data reveals that up to 90% of a fund's return variability stems from asset allocation. This highlights how crucial a balanced mix is for consistent performance.

Balancing growth-oriented assets like stocks with stable ones like bonds creates a resilient structure. Alternatives such as real estate add further protection through their low correlation with traditional markets.

Your Blueprint: A Step-by-Step Guide to Portfolio Construction

Start by defining your financial objectives clearly. Consider your age, income, and future needs to set realistic goals that guide every decision.

- Define Goals, Timeline, and Risk Tolerance: Outline what you want to achieve and when. For instance, if retirement is 35 years away, you might allocate more to stocks for growth.

- Establish Asset Allocation Foundation: Decide on the core mix of stocks, bonds, and cash. This foundation drives long-term performance and stability.

- Diversify Within and Across Categories: Don't just pick stocks; include value, small-cap, and international options to spread risk effectively.

- Incorporate Geographic and Sector Spread: Add assets from different regions and industries to avoid concentration in one economy or sector.

- Balance Risk Profiles: Mix low-risk stability with high-risk growth to suit your appetite and financial situation.

- Rebalance Regularly: Adjust your portfolio periodically to maintain target weights, especially after market shifts or gains.

- Implement Tax-Smart and Income-Focused Strategies: Use tax-efficient vehicles and income sources like dividends for steady cash flow and enhanced returns.

This systematic approach ensures your portfolio aligns with your personal circumstances and long-term vision.

Visualizing Success: Sample Portfolio Allocations

To help you get started, here are templates based on different risk levels. Use these as a reference and customize them to fit your specific goals and comfort zone.

Advanced Strategies for Enhanced Resilience

Beyond basic allocation, several advanced techniques can fortify your portfolio. These strategies are especially relevant in today's economic climate of uncertainty and volatility.

- Rebalancing is Critical: If your portfolio becomes overweight in stocks, trim them back to target levels to avoid excess risk and maintain balance.

- Utilize High-Quality Bonds: For fixed income, choose bonds with strong credit ratings to ensure stability and effective diversification against equity downturns.

- Explore International and Value Stocks: Adding exposure to non-US markets and undervalued companies can boost long-term returns and reduce dependency on single economies.

- Incorporate Alternatives for Income: Assets like private credit or infrastructure offer higher yields than traditional bonds, with low correlation to public markets.

- Balance Geographic and Sector Exposure: Diversify across US, Europe, and Asia, and multiple industries to mitigate regional downturns and sector-specific risks.

Structured notes, for example, have shown principal protection rates above 93% over two decades, making them a reliable tool for risk management in turbulent times.

Key Statistics to Build Confidence

Understanding the data behind diversification can reinforce your trust in these strategies and help you make informed decisions.

- Asset allocation explains 90% of the variability in fund returns over time, underscoring its importance in portfolio design.

- Structured notes with a 15% buffer have provided 93.49% principal protection over 20 years, offering safety in volatile markets.

- For younger investors, starting with higher equity allocations can leverage long-term growth potential effectively, compounding returns over decades.

- Tax reliefs like EIS/SEIS offer up to 50% income tax relief for venture capital investments, enhancing after-tax returns significantly.

- Rebalancing a portfolio that has drifted to 80% stocks back to a 60/40 mix restores intended risk levels and stability, preventing overexposure.

Common Pitfalls to Avoid

Even with the best plans, mistakes can undermine your portfolio's reliability. Being aware of these can save you from costly errors and emotional setbacks.

- Avoid Concentration Risk: Don't put too much into a single stock or sector, like the tech giants that have surged recently, to prevent devastating losses.

- Guard Against Behavioral Biases: Emotional decisions during market swings can lead to overreactions and poor timing, derailing long-term goals.

- Don't Neglect Tax Efficiency: Failing to use tax-advantaged accounts can erode your returns significantly over time, reducing overall wealth accumulation.

- Update Your Strategy Regularly: As your life changes, so should your portfolio to reflect new goals, risk levels, and economic conditions.

- Use Low-Cost Index Funds: High fees can eat into your gains, so opt for cost-effective investment vehicles to maximize net returns.

Tools and Philosophies for Lasting Trust

Embracing proven investment philosophies can guide your decisions and build confidence in your portfolio, ensuring it stands the test of time.

- Modern Portfolio Theory (MPT) optimizes risk and return by selecting a diversified mix of assets, providing a scientific basis for allocation.

- Low-cost index funds provide broad market exposure without the high fees of active management, simplifying investment and reducing costs.

- Regular monitoring and adjustment ensure your portfolio stays aligned with your objectives, adapting to personal and market changes.

- Education and continuous learning empower you to make informed choices as markets evolve, fostering a proactive approach to wealth management.

Remember, a trustworthy portfolio is not built overnight. It requires patience, discipline, and a commitment to long-term principles. By following these guidelines, you can create financial security that endures through all market conditions, turning aspirations into reliable riches.