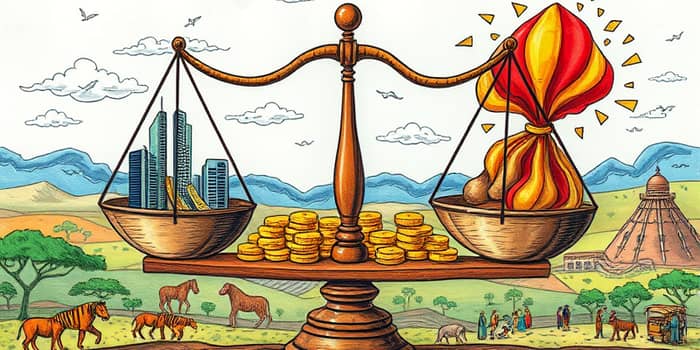

In the ever-evolving landscape of global finance, frontier markets stand as the final frontier for adventurous investors.

These economies, nestled between emerging and developed nations, promise high long-term return potential but come with a host of risks that demand careful navigation.

For those seeking to diversify and capture growth, understanding this dynamic segment is crucial.

This article delves into what frontier markets are, why they matter, and how to approach them with both optimism and caution.

Frontier markets are developing economies that are more advanced than least developed countries but do not yet qualify as emerging markets.

Coined in 1992 by Farida Khambata of the International Finance Corporation, the term describes smaller, less liquid markets with unique characteristics.

They are often seen as pre-emerging markets, hinting at their potential to graduate to a higher status over time.

Key features distinguish them from their emerging counterparts.

These factors create a challenging yet opportunistic landscape for investment.

Different index providers classify countries variably, leading to a diverse list of frontier markets.

This table outlines how major providers like FTSE, MSCI, S&P, and Russell categorize key nations, highlighting the fluid nature of these classifications.

Classifications evolve annually, with countries like Colombia having graduated to emerging status in the past.

This fluidity underscores the dynamic nature of frontier markets.

Frontier markets attract investors with the promise of substantial returns and diversification benefits.

Their low correlation with developed and emerging markets can reduce portfolio risk.

Key drivers of growth include demographic trends and urbanization.

This diversity offers a buffer against systemic risks.

Access methods have improved with indices and ETFs, such as the MSCI Frontier Index.

Blended finance models, combining public and private capital, de-risk investments and address challenges like poverty.

Early movers can gain significant advantages in these high-growth environments.

Despite the rewards, frontier markets are fraught with risks that require careful management.

Investors must be aware of the potential pitfalls to avoid costly mistakes.

Geopolitical factors, such as trade restrictions, can stunt growth unexpectedly.

Climate and social vulnerabilities, like displacement risks, add another layer of complexity.

Local knowledge is essential to navigate language barriers and cultural nuances.

Investor reluctance often stems from misunderstandings about the true nature of these risks.

To succeed in frontier markets, adopt strategies that balance ambition with prudence.

Practical steps can help mitigate risks and maximize returns.

Unconventional partnerships, like those between international organizations and local entities, can unlock opportunities in hard-to-reach areas.

Average investors should assess suitability based on their risk tolerance and portfolio goals.

Diversification within frontier markets themselves can reduce specific country risks.

The evolution of frontier markets is ongoing, with many poised for graduation to emerging status.

Historical trends show that with development, these economies can integrate more deeply into global finance.

Diversification benefits contradict the notion that frontier markets always add risk.

Private solutions are emerging to tackle poverty and environmental challenges in these regions.

The journey is not without setbacks, but the potential for transformative growth remains compelling.

By staying informed and adaptable, investors can participate in this exciting frontier.

Frontier markets embody the spirit of exploration in finance.

They offer a chance to be part of economic stories that are still being written.

With careful strategy and unwavering vigilance, the rewards can far outweigh the stakes.

Embrace the challenge, and you may find opportunities that redefine your investment horizon.

References